What Neuroscience Can Inform Us about Brand Equity II

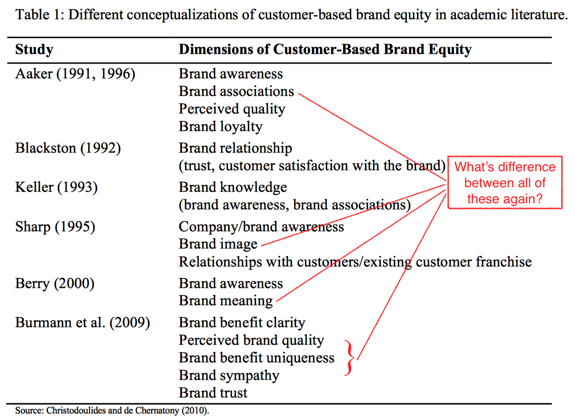

While researching for the paper, something that struck me was the lack of agreement on even basic concepts of “brand equity”. Below is a (likely complete) list of dimensions of “customer-based” brand equity proposed in the literature. (Contrasted with firm-based brand equity which is typically calculated from financial data).

What’s really striking is how they are so similar and different at the same time. I’m not trying to pull a post-modernism trick. For example, consider something like “brand awareness”, which flits in and out of the various frameworks. It clearly has some relationship with brand associations, since one can’t be aware of something that has no associations (or can it?). But what is that relationship and how is it distinct from brand associations? Trust me, it doesn’t get any better than that.

A basic contribution of neuroscience, then, is to simply provide a more rigorous framework to conceptualize these marketing typologies. No psychologist studying “knowledge”, “associations”, and “awareness” would be ignorant of the fundamental contribution cognitives neuroscience has made to these topics. I don’t think it’s crazy to suggest that the same should apply to consumer researchers. As for what I tentatively propose as a more biologically-plausible framework? That, as they say, requires you to read the paper.

More generally, I’ve found that a useful way to think about what neuroscience can contribute to marketing and consumer research is to ask, “What do consumer researchers think they are studying/measuring?” This might seem either obvious or unnecessarily antagonistic, depending on your perspective. But it is quite different from the way the questions as they are typically posed currently, which is more akin to “What can [enter your technique] tell me about [enter what marketer/consumer researcher is interested in]?” At the risk of making sweeping generalizations (which of course I will now be making), a real issue this runs into is that what marketers are interested in are often surprisingly ill-defined. I don’t think this is a knock on marketers because the real-world is complicated. Plenty of health researchers study “resilience” but nobody really knows how to define it. The real problem is in refusing to entertain the possibility that one can provide a more rigorous scientific foundation of these “fuzzy” concepts.

What Neuroscience Can Inform Us about Brand Equity

Hsu, Ming. Customer-based brand equity: Insights from consumer neuroscience. in Moran Cerf and Manuel Garcia (eds.) Consumer Neuroscience. MIT Press, Forthcoming.

This review describes how insights from cognitive and behavioral neurosciences are helping to organize and interpret the relationship between consumers and brands. Two components of brand equity—consumer brand knowledge and consumer responses—are discussed. First, it is argued that consumer brand knowledge consists of multiple forms of memories that are encoded in the brain, including well-established forms of semantic (attributes and associations) and episodic (experiences and feelings) memory. Next, it is argued that there exist distinct forms of consumer responses that correspond to distinct behavioral systems—a goal-directed system that captures valence of attitudes and preference for a brand, and a habit system that captures previously learned values but no longer reflect ongoing preferences. Finally, a neuroscientifically-grounded conceptualization is proposed with the aim of ultimately improving measurement of brand equity and its effects on financial returns.