Neuromarketing vs. Status Quo

Here’s what each looks like to me:

- Status quo: Assume that consumer can be trusted to tell us the truth, at least most or all of the time. Otherwise it becomes difficult to convince clients to buy what we have to sell.

- Neuromarketing: Assume that consumers cannot be trusted, at all. Otherwise it becomes difficult to convince clients to buy what we have to sell.

Assume that consumers cannot be trusted.

It doesn’t require too much common sense to see what these positions are incompatible because of how each positions their products and services. The more reasonable, but maybe not as sexy or eye-ball attracting, position has got to be:

- Neuromarketing 2.0: Sometimes consumers can’t or won’t tell us the truth. We will help you figure out when those sometimes are.

Oh, we might even be able to tell you what consumers are not revealing, but don’t trust us until we can validate it in some way.

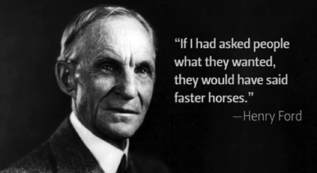

Who wouldn't want a faster horse?

These days, the sentiment is captured most famously by Steve Jobs, who once said, “Customers don't know what they want.” Of course the actual sentiment goes back much, much farther. One of my favorites is from Henry Ford, who said, “If I had asked people what they wanted, they would have said faster horses.”

On the other hand, when it comes to actually doing marketing research, I would say that more than 90% of the students use and rely heavily on self-report measures. And you know what, for the most part they turn out great!

So what's going on here? Are we instructors just great at indoctrinating students? That'd be a great skill to have, but what's actually going on is that the students gain a more nuanced appreciation for what self-report can and cannot tell us. If we parsed Ford's statement a bit more, we can actually generate two insights (or more realistically, hypotheses). One is that people want something faster (okay, not exactly earth shattering news), but the second is that people are bound up in the past, and have little insights into how to actually deliver these features. To a savvy entrepreneur, this should raise all sorts of interesting additional questions about challenges and opportunities in introducing a new product.

Of course, not everyone has taken a marketing research course, and not market researchers still have considerable difficulty in convincing people of the validity of their insights. The good news though is that (i) my job is safe for a while, and (ii) there's plenty of room for improvement.

Trust but Verify? But…how?

Researchers at UC Berkeley’s Haas School of Business are using functional magnetic resonance imaging (fMRI) to see if what people say about brands matches what they are actually thinking.“Surveys and focus groups are the work-horses for generating customer insights. They are fast, inexpensive, and offer tremendous value for marketers,” explains Hsu, who served as senior author of the study, “However, the inherent subjectivity of these measures can sometimes generate skepticism and confusion within companies, often leading to difficult conversations between managers within marketing and those outside.”

“We were able to predict participants’ survey responses solely from their brain activity,” says Chen. “That is, rather than taking participants’ word at face value, we can look to their neural signatures for validation.”

Although conducting fMRI studies on a routine basis is still likely to be cost prohibitive for most companies, the current findings point to a future where marketers can directly validate customer insights in ways that were not possible before.

[Full release] [Full Study]

Science of Business, Business of Science

What is this blog about?

Two things.

1. Science of business: How can we use science to improve the current state of managerial practice, foster innovation, and reduce ethical violations? This includes scientific thinking for example through the use of data and experimentation. It also includes attempts to introduce entirely new types of data from the natural sciences, such as neuroscience and genetics. What are the areas of promise, of hype? How should we evaluate claims? How can we make progress?

2. Business of science: How can we improve efficiency and effectiveness of current scientific enterprise? Scientists are increasingly being asked to show the bottom line impact of their research, but how should we measure value of scientific research? How do we balance competing demands of basic and translational research?

Why do we need yet another blog about this?

Because these topics don’t seem to be discussed much in the blogosphere. Email me if you think someone is doing it better. I will either a) try harder, b) fold and use the time for something more productive, or (c) respond with some snarky defensive response (I kid, I kid!).Why are you qualified to write this?

Through some interesting and not-so-interesting career quirks, I ended up with training in economics, neuroscience, and psychology, and am now teaching at a business school. This means that I spend part of my day wearing my bschool hat, which involves me thinking and teaching marketing, especially topics like marketing research and the role of data in business. The rest of the time is spend with me wearing my basic scientist hat, where I direct the Neuroeconomics Lab, where my research team and I conduct research on the neuroscience and genetics of economic decision-making.Over the years, I find myself increasingly comfortable at putting on my bschool hat while thinking about science, and putting on my science hat while thinking about business. I’ve also come to realize that there is a lot of each area can learn from the other, hence this blog.