What Neuroscience Can Inform Us about Brand Equity II

Since most people these days don’t have the time to actually read papers, here is what I think are the highlights from our paper that might surprise people in terms of what neuroscience can inform us about brand equity.

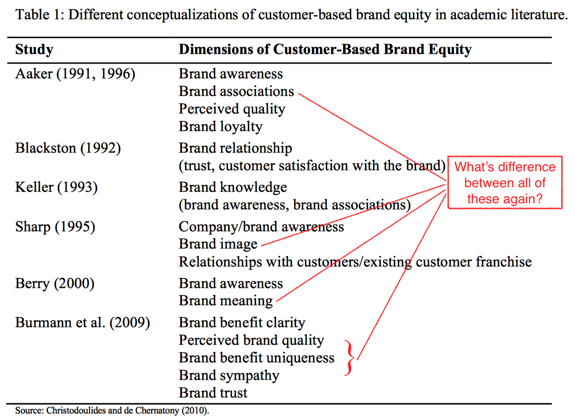

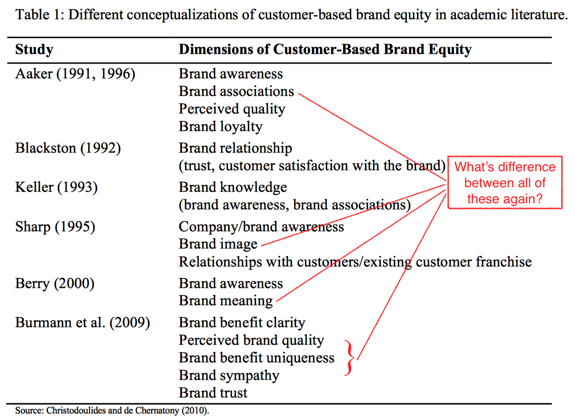

While researching for the paper, something that struck me was the lack of agreement on even basic concepts of “brand equity”. Below is a (likely complete) list of dimensions of “customer-based” brand equity proposed in the literature. (Contrasted with firm-based brand equity which is typically calculated from financial data).

What’s really striking is how they are so similar and different at the same time. I’m not trying to pull a post-modernism trick. For example, consider something like “brand awareness”, which flits in and out of the various frameworks. It clearly has some relationship with brand associations, since one can’t be aware of something that has no associations (or can it?). But what is that relationship and how is it distinct from brand associations? Trust me, it doesn’t get any better than that.

A basic contribution of neuroscience, then, is to simply provide a more rigorous framework to conceptualize these marketing typologies. No psychologist studying “knowledge”, “associations”, and “awareness” would be ignorant of the fundamental contribution cognitives neuroscience has made to these topics. I don’t think it’s crazy to suggest that the same should apply to consumer researchers. As for what I tentatively propose as a more biologically-plausible framework? That, as they say, requires you to read the paper.

More generally, I’ve found that a useful way to think about what neuroscience can contribute to marketing and consumer research is to ask, “What do consumer researchers think they are studying/measuring?” This might seem either obvious or unnecessarily antagonistic, depending on your perspective. But it is quite different from the way the questions as they are typically posed currently, which is more akin to “What can [enter your technique] tell me about [enter what marketer/consumer researcher is interested in]?” At the risk of making sweeping generalizations (which of course I will now be making), a real issue this runs into is that what marketers are interested in are often surprisingly ill-defined. I don’t think this is a knock on marketers because the real-world is complicated. Plenty of health researchers study “resilience” but nobody really knows how to define it. The real problem is in refusing to entertain the possibility that one can provide a more rigorous scientific foundation of these “fuzzy” concepts.

While researching for the paper, something that struck me was the lack of agreement on even basic concepts of “brand equity”. Below is a (likely complete) list of dimensions of “customer-based” brand equity proposed in the literature. (Contrasted with firm-based brand equity which is typically calculated from financial data).

What’s really striking is how they are so similar and different at the same time. I’m not trying to pull a post-modernism trick. For example, consider something like “brand awareness”, which flits in and out of the various frameworks. It clearly has some relationship with brand associations, since one can’t be aware of something that has no associations (or can it?). But what is that relationship and how is it distinct from brand associations? Trust me, it doesn’t get any better than that.

A basic contribution of neuroscience, then, is to simply provide a more rigorous framework to conceptualize these marketing typologies. No psychologist studying “knowledge”, “associations”, and “awareness” would be ignorant of the fundamental contribution cognitives neuroscience has made to these topics. I don’t think it’s crazy to suggest that the same should apply to consumer researchers. As for what I tentatively propose as a more biologically-plausible framework? That, as they say, requires you to read the paper.

More generally, I’ve found that a useful way to think about what neuroscience can contribute to marketing and consumer research is to ask, “What do consumer researchers think they are studying/measuring?” This might seem either obvious or unnecessarily antagonistic, depending on your perspective. But it is quite different from the way the questions as they are typically posed currently, which is more akin to “What can [enter your technique] tell me about [enter what marketer/consumer researcher is interested in]?” At the risk of making sweeping generalizations (which of course I will now be making), a real issue this runs into is that what marketers are interested in are often surprisingly ill-defined. I don’t think this is a knock on marketers because the real-world is complicated. Plenty of health researchers study “resilience” but nobody really knows how to define it. The real problem is in refusing to entertain the possibility that one can provide a more rigorous scientific foundation of these “fuzzy” concepts.